Is IndyCar staring into the engine abyss?

Like increasingly desperate parents searching for a child lost in the wilderness, the corner office guys at the IndyCar head office in the US are feverishly scouring the globe for a vehicle manufacturer willing to join the series as an engine supplier from 2027.

By Wayne Webster.

Wayne Webster is a longstanding motoring/motorsport journalist with a quick wit-who never fails to call a spade a spade…The simple fact is, he has an enquiring mind and he knows his stuff when it comes to the motorsport scene. In this case, he examines the potential loss of Honda as an engine supplier to the IndyCar series…

With only two years to go before the introduction of an all-new car and a host of regulation changes in America’s premier open-wheeler category, IndyCar is speaking to any and all OEM companies who will answer the phone to try and coax a third or, dare to dream, even a fourth, engine supplier into the series.

The series with the ‘Greatest Spectacle in Motorsport’ is facing its greatest existential crisies

Despite being arguably one of, if not the most competitive racing series in the world, IndyCar is facing a powerplant crisis. Currently, IndyCar has two engine suppliers, Chevrolet and Honda.

In 2025, they will share the load almost equally, powering the 27 regular-season entries. Both companies have contracts that expire at the end of the ‘26 season. But unless a new, third manufacturer can be brought into the engine fold to help share the load, IndyCar may find itself with just one and in a world of pain.

Hence, the nervous looks and sweaty upper lips of those with the big offices at the IndyCar HQ in Indianapolis, Indiana, rather appropriately.

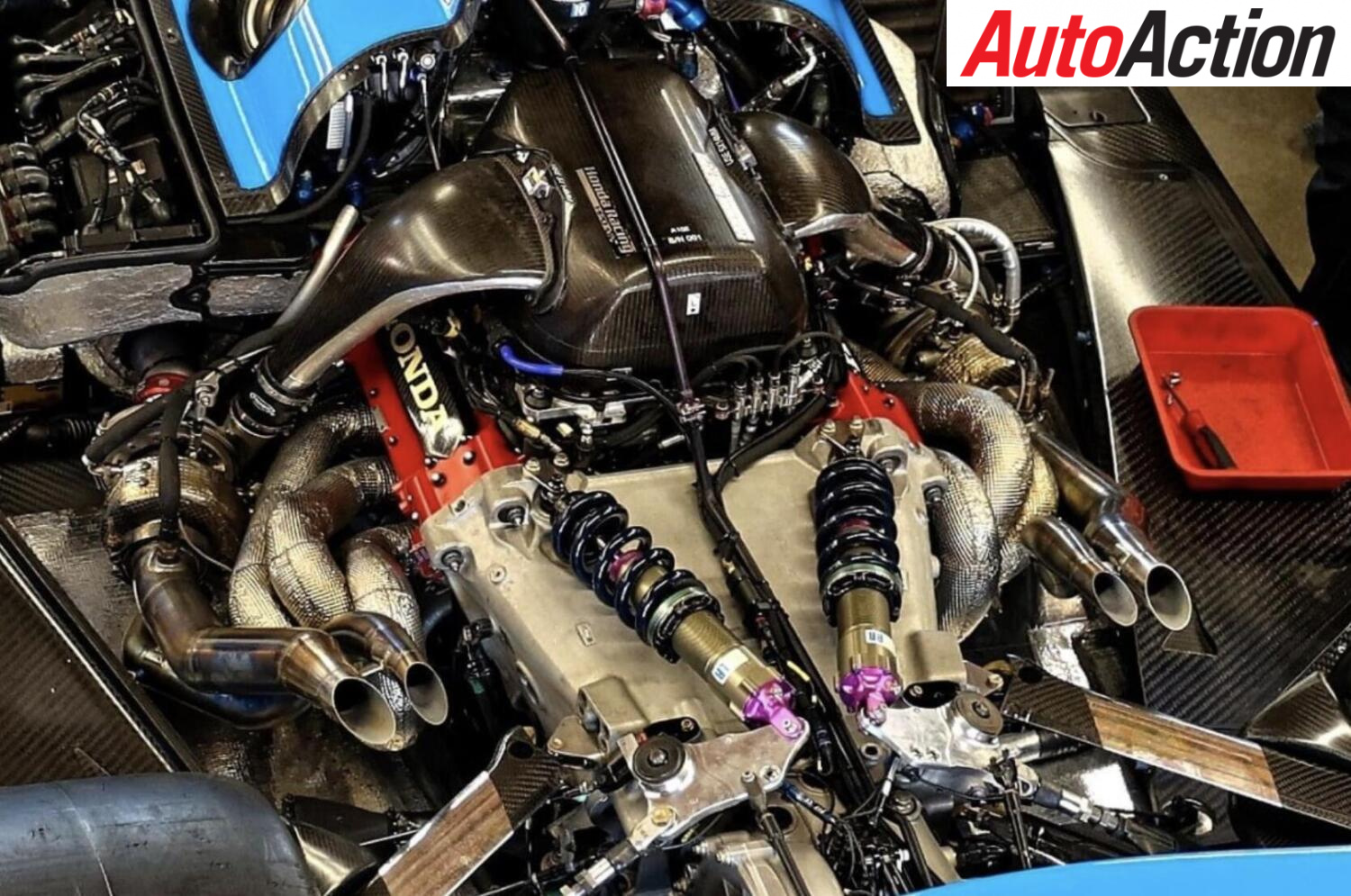

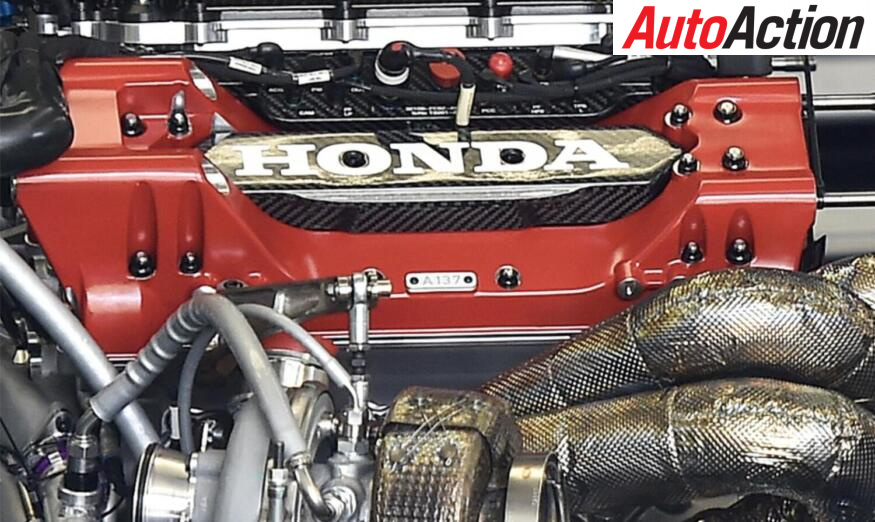

Honda, which manufactures IndyCar engines through its Honda Racing US subsidiary (formerly HPD), is unhappy with its current situation, openly expressing that it’s not receiving the value for its investment in the category.

The very real threat, and the US arm of the Japanese company has made this plainly clear, is that unless another company joins in the fun and lifts the burden that Honda and Chev currently carry, the big H brand will walk away when its contract expires.

Honda is on the edge of its rev limit regarding its future in IndyCar

For Penske Entertainment (the owner of the IndyCar series) CEO Mark Miles, this must be very much a “my anxiety is running down the back of my legs” moment and the reason he has been talking with all and sundry in the hunt for some new engine blood.

According to Miles, there has been “serious interest on the part of prospective newcomers that are paying close attention and doing all you’d expect them to do to understand the costs and their ability to be competitive.”

It is believed that companies currently discussing IndyCar include Toyota, Hyundai, Ford, and, although this may be a practical joke, Lamborghini. But just how has IndyCar found itself in what, really, is quite an embarrassing situation and why is Honda more than just a little pissed off?

Well, as is usually the case, it all boils down to money. It’s all about return on investment (ROI), and Honda believes it’s copping the rough end of the pineapple.

IndyCar is hoping to introduce one or two more engine manufacturers by 2027 to ease the shared load of Honda and Chevrolet

Both Honda and Chev lease their engines to the teams at a cost of around $2.4 million per car a year. The two suppliers allocate five engines to each car for the season and rotate them regularly for servicing and rebuilds. However, leaked figures from Honda, probably deliberately, indicate that each car supply costs the company $3.3 million. You do the maths!

Basically, that indicates that supplying its 13-car fleet in 2025, not including the one-off Indy 500 runners, will leave the company almost $12 million in the red. And Honda believes that $12 million isn’t justified by the recognition it receives and may be better off just plonking that big wad of cash into traditional advertising.

But a third manufacturer could save the day, helping to share the load and, obviously, reducing the current pair’s spending. Both have said their preference would be to supply only 8-10 cars per year, the former being the better option.

Just to complicate matters, IndyCar would love to have an all-new engine for 2027 when it introduces Dallara’s next-generation chassis wearing, hopefully, a radically new aero package that will make the US-based racers eye-poppers.

This would mean ditching the 2.2-litre V6 twin-turbo units currently in use. Producing around 560kW of power (recently boosted by the introduction of the electric MGU, which adds something like 90kW), the ‘power units’ have done sterling service to the category since way back in 2012.

IndyCar introduced an MGU unit to its series in 2024, providing a 90kW boost in power

Introducing a new powerplant, the preferred option being a slightly larger 2.4 litre twin turbo V6, would cost both Chevrolet and Honda tens of millions of dollars in research and development, testing and time. And, in engine development terms, time is the enemy, and 2027 really, in the big scheme of things, isn’t all that far away.

So, let’s get to the worst-case scenario, which is if IndyCar can’t entice a third manufacturer into the series and Honda throws up its corporate hands, takes its bat and ball, and goes home.

The company as Honda or Acura, could quite easily up its participation in the booming IMSA category with the Acura-badged LMDh racers and, maybe, just maybe, also move the brand into the WEC.

Of course, there is a doomsday plan sitting in the bottom drawer in Mark Miles’ desk, but it really is a last resort option.

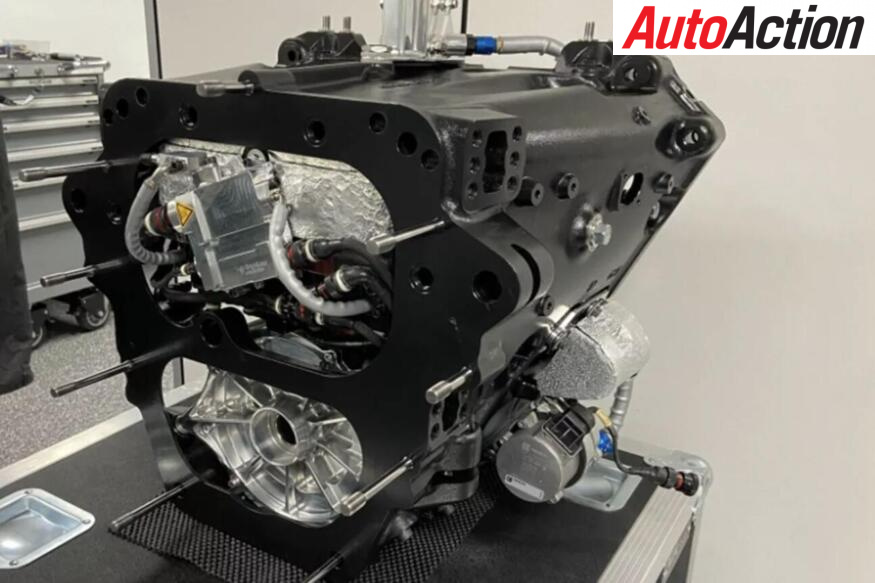

Chevrolet’s current IndyCar engine is made by engineering powerhouse Ilmor Engineering, which boasts manufacturing bases in both the US and UK.

Ilmor, rather conveniently, was co-founded and is co-owned by billionaire Roger Penske, who also owns, among a vast portfolio of big stuff, the IndyCar series itself and the legendary Indianapolis Motor Speedway.

To supply each Dallara chassis with its allotted amount of 2.2-litre V6 twin-turbo engines costs around $3.3 million per car

The company could, with some significant investment and expansion, supply a spec engine for the entire IndyCar field and fence-sitting manufacturers could be invited in, at a cost, to simply badge the engines for the teams of their choosing and avoid all that pesky expense of R&D and having a factory to make the damn things.

Hardly the preferred option when all is said and done, but in the end, something is better than nothing – because having an all-new car for 2027, no matter how sexy it looks, would be pretty pathetic without something to make it go.

READ THE LATEST ISSUE OF AUTO ACTION HERE

Don’t forget the print edition of Auto Action available via subscription here. For more of the latest motorsport news, subscribe to AUTO ACTION magazine.